(“Who Must File A 1040 ASAP To Get A Stimulus Check” redirects here.)

“The most recent guidance states that, at least for SS recipients, some veterans and others not otherwise required to file, no return is necessary … There now is no need for these people to file an ‘abbreviated’ return, whatever that is.” – Dan Pilla, the nation’s leader in taxpayers’ rights defense and IRS abuse prevention and cure

IRS-published information on the economic stimulus checks promised to hundreds of millions of Americans has produced widespread confusion.

To get straight answers, Headline Health turned to Dan Pilla, who has been helping taxpayers resolve IRS problems for 40 years.

The Associated Press once noted that “Dan Pilla probably knows more about the IRS than the commissioner.”

Here’s Dan’s summary of what’s happening with stimulus checks …

By Dan Pilla, taxhelponline.com, April 10, 2020

ECONOMIC IMPACT PAYMENTS –

The Centerpiece of CARES

The center-piece of CARES is the so-called “economic impact payment” that will be handed out to most Americans.

This combination stimulus/relief payment is intended to provide families with immediate cash to hold them over while businesses are closed because of the “stay-at-home” orders now in effect in most states.

The IRS stated on March 30 that the distribution of checks will begin in about three weeks. It is estimated that 165 million people, or 93% of all tax return filers, will get some cash.

About 140 million will get the full amount of $1,200. The payment is actually considered a credit against your 2020 income tax liability.

As such, it is not subject to being taxed. Even if you don’t owe taxes, you could get cash because the payment is considered a “refundable” credit. As such, it’s treated just like the Earned Income Tax Credit.

You must have a Social Security number to get paid. That includes the SSN of the taxpayer and his spouse, and the SSNs of any dependents. Without a valid SSN, you will not receive a payment. See: new code §6428(g).

Here’s what you can expect in the way of payment.

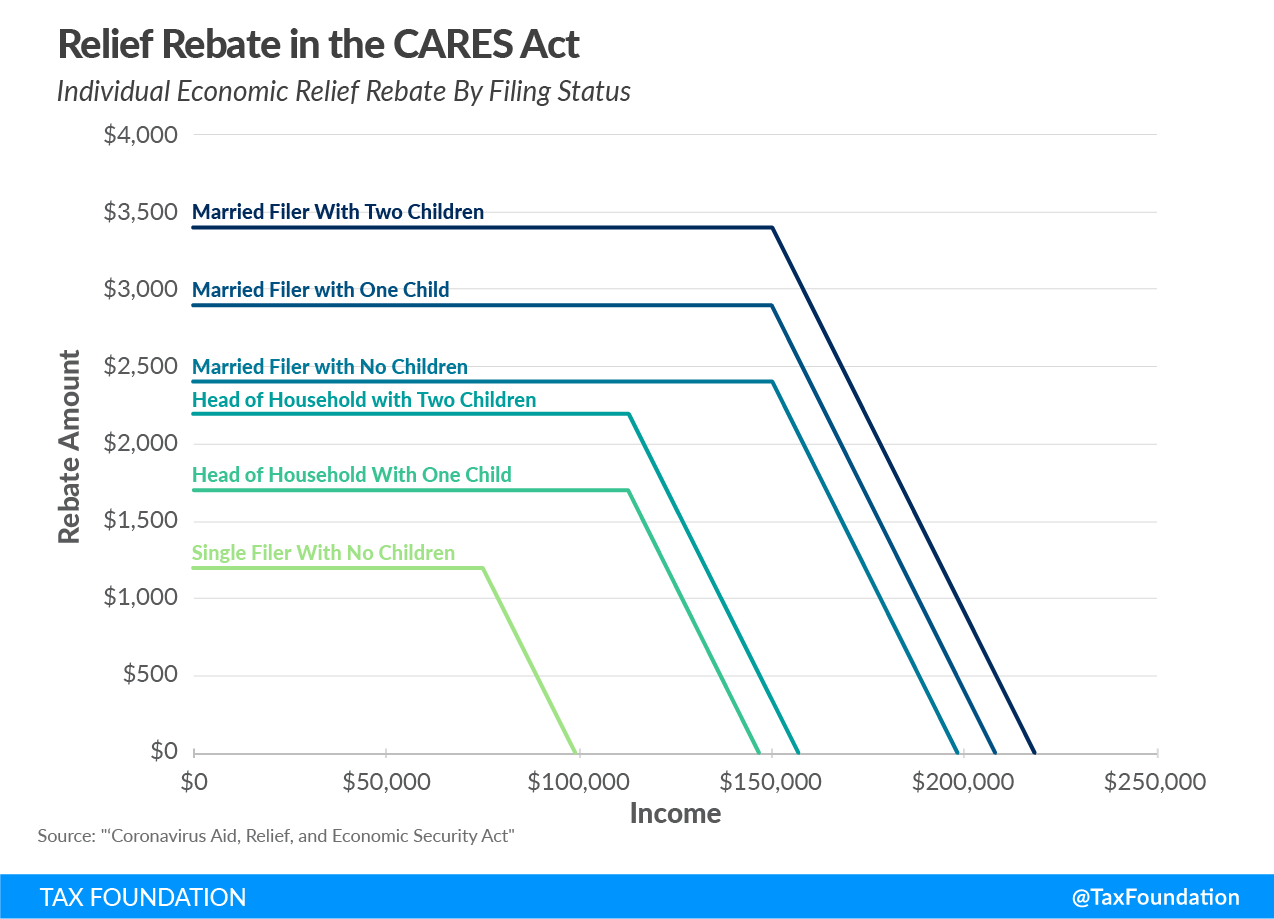

- If your adjusted gross income (AGI) is less than $75,000 for a single person, or $150,000 for a married couple filing jointly, you’ll get $1,200 per individual.

- Plus, you get an additional $500 for each child under 17. A family of four will get a check for $3,400. There is no limit to the number of children to which the $500 applies. See new code §6428(d).

- If your AGI exceeds the above amounts, the credit is phased out. Under the phase-out rules, the credit is gradually reduced to zero by the point at which AGI exceeds $99,000 for individuals, $146,500 for heads of household, and $198,000 for joint filers.

The chart below, produced by the Tax Foundation (www.taxfoundation.org), illustrates these numbers.

The rebate is based on your 2019 tax return or your 2019 Social Security statement, if Social Security is your only income.

If you haven’t yet filed the 2019 return, the rebate is based on your 2018 return. As readers of Pilla Talks Taxes learned in last month’s issue, the filing deadline for 2019 returns is now moved to July 15, 2020.

“If you filed neither your 2018 tax return, nor your 2019 return, you need to get busy.”

The best bet is to get the return filed as soon as possible, especially if your 2019 income is lower than 2018 such as to impact the amount of the rebate you’re entitled to.

The IRS will process the rebate checks through the end of 2020.

The IRS intends to deliver the checks via direct deposit. They will put the money in the account indicated on the tax return to which the tax refund payment was made.

If no bank account information was provided, you should to provide that information to the IRS to get your money as fast as possible. In the coming weeks, the IRS says it will have a portal on its web site allowing individuals to provide their current bank account information. If there simply is no bank account available, the IRS will mail you a check.

If you filed neither your 2018 tax return, nor your 2019 return, you need to get busy. It appears that you will not get a rebate check if either of these returns remains unfiled through 2020.

Earlier in the week of March 30, the IRS said that if a person didn’t file a return because their income was too low to require filing, that person would have to file an “abbreviated” return to get the payment. I don’t know what an “abbreviated” return is.

I assume the IRS meant you would file a return to prove you don’t have to file a return, for the purposes only of providing proof of your income and bank account information. Those receiving only Social Security payments might fall into this category.

As of April 1, the Treasury reversed itself on that point. The most recent guidance states that, at least for SS recipients, some veterans and others not otherwise required to file, no return is necessary. The IRS will simply deposit their checks directly into their bank accounts where the SS or other federal benefits are paid. There now is no need for these people to file an “abbreviated” return, whatever that is.

To learn more, visit www.taxhelponline.com. For a copy of Dan Pilla’s Small Business Tax Guide – a must-read for any small business owner – click here.